april 2016 service tax rate

In general 2016 individual tax returns are due by Monday April 17 2017. And the minimum present value transitional rates for April 2016.

2021 tax brackets taxes due April 2022 or October 2022 with an extension Tax rate Single Head of household Married filing jointly or qualifying widow Married filing separately.

. For a single person making between 9325 and 37950 its 15. 100000- then penalty shall be Rs. Services provided by Government by way of deputing officers after office hours or on holidays for inspection or container stuffing or such other.

April 25 2022 at 217 pm. New Delhi the 20 th June 2012. An official study by the European Commission suggests a flat 001 tax would raise between 164bn and 434bn per year or 013 to 035 of GDP.

Updates for the corporate bond weighted average interest rate for plan years beginning in May 2016. The due date to deposit the service tax is 06062016. Notice 2016-29 2016-18 IRB.

Leprechaun economics was a term coined by economist Paul Krugman to describe the 263 per cent rise in Irish 2015 GDP later revised to 344 per cent in a 12 July 2016 publication by the Irish Central Statistics Office CSO restating 2015 Irish national accounts. There were no sales and use tax county rate changes effective July 1 2022. This article gives you the tax rates and related numbers that you will need to prepare your 2016 income tax return.

Download the latest list of location codes and tax rates in Excel file format. If the amount of service tax short paid not paid short levied not levied or erroneously refunded was Rs. At summer Budget 2015 the government announced a reduction in the Corporation Tax rate from 20 to 19 for the financial years beginning 1 April 2017 1 April 2018 and 1 April 2019 with a.

M M Reddy says. Quarter 3 2022 July 1 - Sept. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington.

Mandatory electronic filing of public service company tax returns. The good news is you only pay 10 on all income up to 9325 then 15 on income up to 37950 and so on. Additional Tax Types Required to be Paid by Electronic Funds Transfer EFT 2011-03.

Your deduction for 1985 through 2003 is shown in the following table. The funding transitional segment rates applicable for May 2016. The sales and use tax rate for Coshocton County 16 will increase from 725 to 775 effective April 1 2022.

2022 2 nd Quarter Rate Changes. 2016 Revised Maui County Fuel Tax Rate Effective July 1 2016. Estimating Your Retirement Tax Income.

7½ April 1 2011. March 4 2016. Quarter 2 2022 April 1 - June 30.

At that point the distortion of Irish economic data by tax-driven accounting flows reached a climax. 2022 2021 2020 2019 2018 2017 2016 2015 2014 Effective 2022 Local sales. Tax rates and related numbers that you will need to prepare your 2016 income tax return.

March 31 2011. This is in the basic rate tax band so you would pay. The summary of rate of service tax applicable for different period is also given below.

6 April 2016 to 5 April 2017. 100000 and total amount payable shall be Rs. Interest Rates on Tax Underpayments Interest Rates.

Internal Revenue Service Tax Forms and Publications. Naturally estimated revenues may vary considerably depending on the tax rate but also on the assumed effect of the tax on trading volumes. Tax rate and revenues.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. Due to changes in the law the IRS cant issue refunds before February 15 2017 for 2016 returns that claim the earned income credit EIC or the additional child tax. The sales and use tax rate for Mahoning County 50 will increase from 725 to 750 effective April 1 2022.

Archived Interest Rate Notices on Tax Underpayments. Deposited the tax in the month of 10102016. 20 tax on 17000 of wages.

During the period prior to 1st April 2016 on payment of licence fee or spectrum user charges as the case may be. Relaxation in Penalty Payment-Provided further that where service tax and interest is paid within a period of thirty days of. The 24-month average segment rates.

Notice of Interest Rates on New York City Income and Excise Taxes for the period. April is the fourth month of your tax year. August 23 2020 at 815 pm.

Taxtips Ca Business 2020 Corporate Income Tax Rates

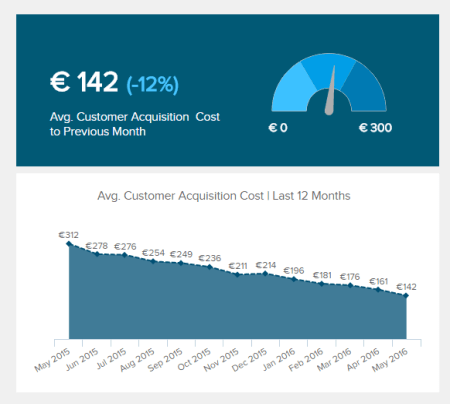

Sales Graphs And Charts 30 Examples For Boosting Revenue

Carbon Taxes Worldwide By Select Country 2021 Statista

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

India National Income Per Capita 2022 Statista

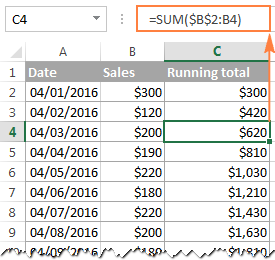

How To Do A Running Total In Excel Cumulative Sum Formula Ablebits Com

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Image Result For Gst In Other Countries List List Of Countries Country Other Countries

Tax Gap A Brief Overview Canada Ca

India National Income Per Capita 2022 Statista

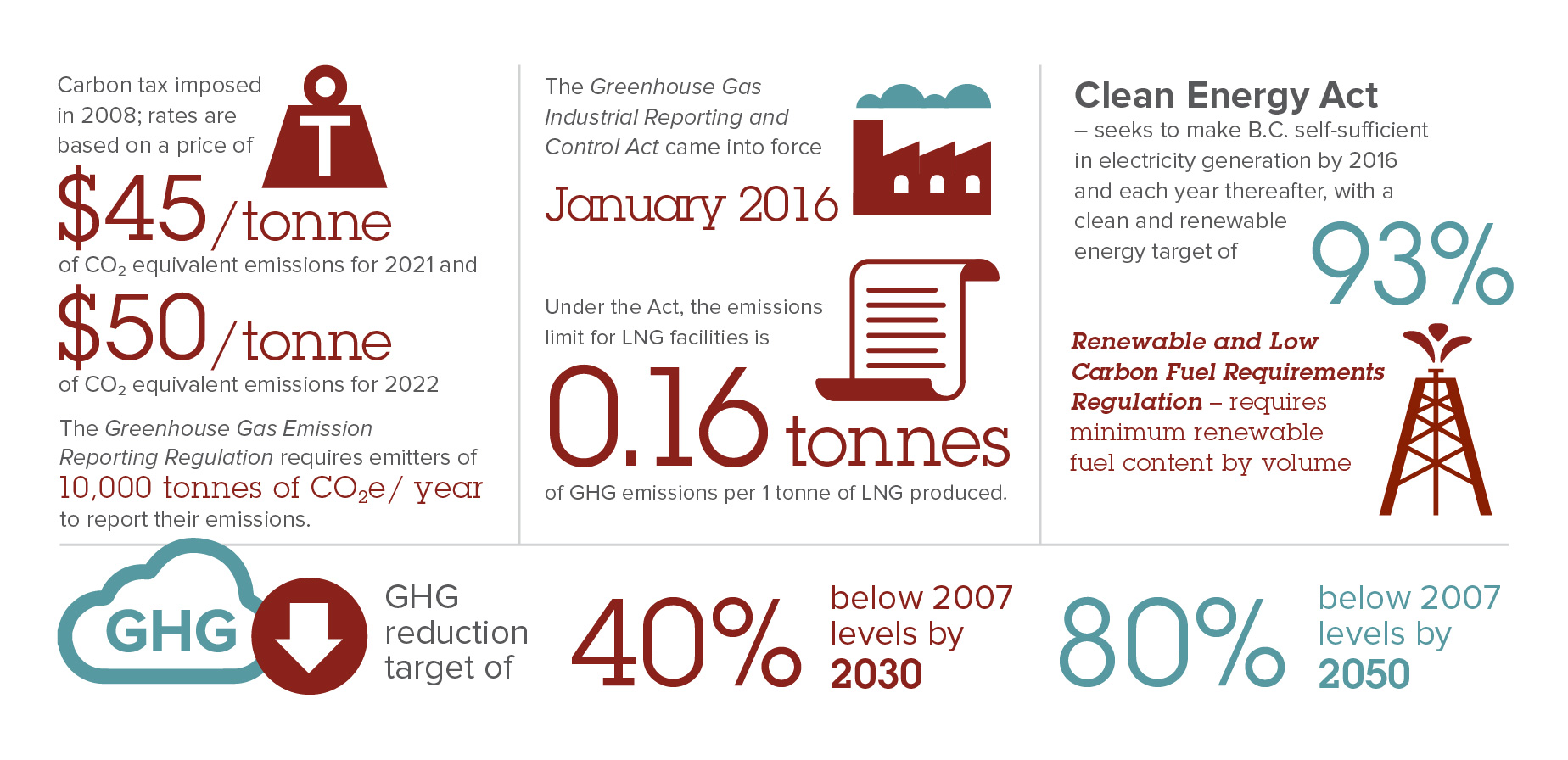

B C S Carbon And Greenhouse Gas Legislation

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

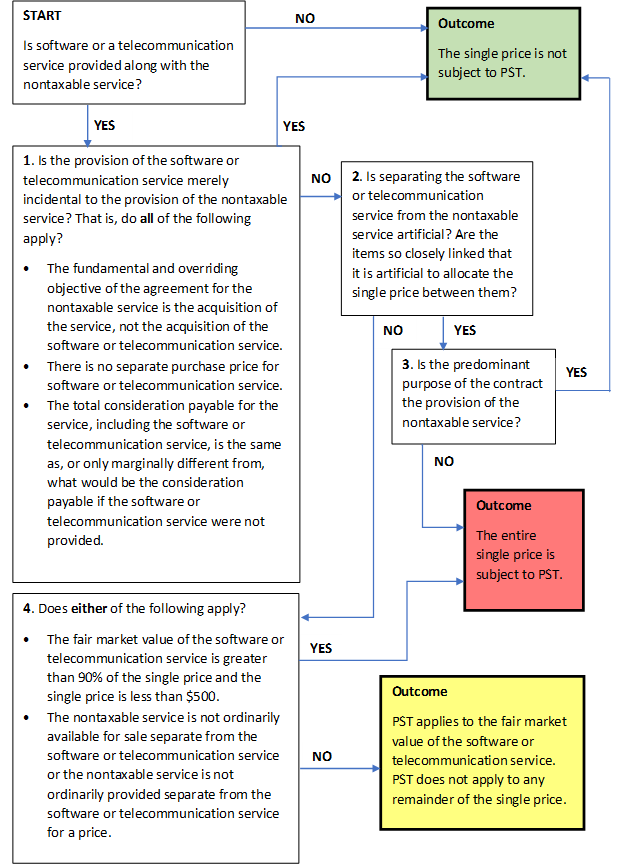

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech